3 Compelling Reasons Non-Profits Should Choose Sage Intacct as Their Business Software Solution

Sage Intacct is the #1 Financial Software for NonProfits

Non-profit organizations face unique challenges that demand tailored solutions. From managing donor relationships to ensuring compliance with financial regulations, non-profits need robust software that can streamline operations and enhance transparency. Sage Intacct stands out as a premier business software solution designed to meet these needs. Here are three compelling reasons why non-profits should choose Sage Intacct.

1. Superior Financial Management and Reporting

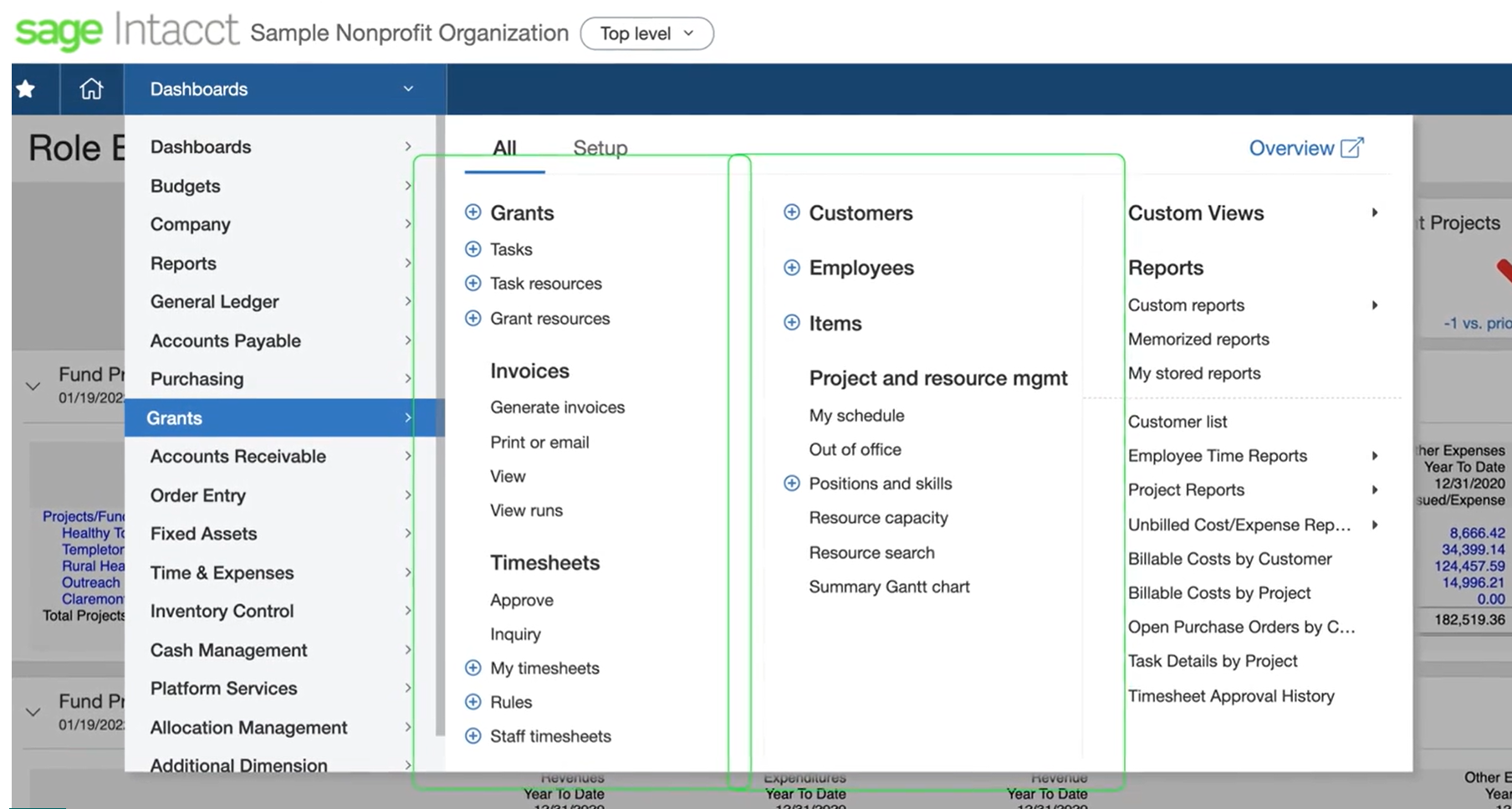

Non-profits often grapple with complex financial management needs, from tracking funds across multiple programs to ensuring compliance with stringent reporting requirements. Sage Intacct excels in providing superior financial management and reporting capabilities tailored to non-profit organizations.

Multi-Dimensional Reporting

Sage Intacct allows non-profits to track and report on financial data across multiple dimensions such as funds, grants, programs, locations, and projects. This multi-dimensional reporting capability enables organizations to gain a comprehensive view of their financial health and program performance. For instance, you can easily generate reports that show how funds are allocated across different programs or track expenses by specific grants, ensuring transparency and accountability.

Real-Time Visibility

With Sage Intacct, non-profits gain real-time visibility into their financial data. The cloud-based platform ensures that financial information is always up-to-date, allowing for accurate and timely decision-making. Real-time dashboards provide a clear overview of key metrics such as revenue, expenses, and budget variances, helping non-profits to stay on top of their financial health.

Compliance and Audit Readiness

Non-profits must comply with various regulatory requirements and prepare for audits regularly. Sage Intacct simplifies compliance by providing built-in tools for tracking and reporting on financial activities. The software’s robust audit trail functionality ensures that all transactions are recorded and traceable, making audit preparation more straightforward and less time-consuming.

2. Enhanced Efficiency and Cost Savings

Operational efficiency and cost savings are critical for non-profits, as they strive to maximize the impact of their resources. Sage Intacct offers several features that enhance efficiency and reduce operational costs.

Automated Processes

Manual processes can be time-consuming and prone to errors. Sage Intacct automates many routine financial tasks, such as accounts payable and receivable, expense management, and payroll processing. This automation not only reduces the likelihood of errors but also frees up staff time, allowing them to focus on mission-critical activities rather than administrative tasks.

Seamless Integration

Non-profits often use a variety of software solutions for different functions, such as donor management, fundraising, and volunteer coordination. Sage Intacct integrates seamlessly with other systems, creating a unified platform that streamlines operations. For example, integration with donor management software ensures that donation data flows directly into the financial system, reducing manual data entry and improving accuracy.

Scalability

As non-profits grow and their needs evolve, Sage Intacct scales with them. The software can accommodate increasing transaction volumes, additional users, and more complex reporting requirements without compromising performance. This scalability ensures that non-profits can continue to rely on Sage Intacct as their operations expand.

3. Improved Donor Engagement and Transparency

Donor engagement and transparency are vital for non-profits to build trust and secure ongoing support. Sage Intacct provides tools that help organizations improve donor engagement and demonstrate transparency.

Donor Management

Sage Intacct’s integration capabilities extend to donor management systems, allowing non-profits to maintain a holistic view of their donor relationships. By integrating financial data with donor information, organizations can generate detailed reports on donor contributions, track donor engagement over time, and identify trends in giving patterns. This information can be used to tailor communication strategies and strengthen donor relationships.

Transparent Reporting

Transparency is crucial for maintaining donor trust. Sage Intacct enables non-profits to create detailed, transparent financial reports that can be easily shared with donors, board members, and other stakeholders. The software’s reporting capabilities ensure that non-profits can provide clear and accurate information on how funds are being used, demonstrating accountability and stewardship.

Fund Accounting

Sage Intacct’s fund accounting features allow non-profits to manage and report on multiple funds, grants, and contributions separately.

This ensures that donor restrictions are respected and that funds are used appropriately. By providing detailed fund accounting reports, non-profits can reassure donors that their contributions are being used as intended.

Why You Should Consider Sage Intacct if You Are a Nonprofit Organization

Sage Intacct offers a comprehensive suite of features tailored to the unique needs of non-profit organizations. From superior financial management and reporting to enhanced efficiency and cost savings, and improved donor engagement and transparency, Sage Intacct provides the tools non-profits need to achieve their mission and maximize their impact. By choosing Sage Intacct, non-profits can streamline their operations, ensure compliance, and build stronger relationships with their donors, ultimately driving greater success for their organization.

Kerr Consulting

Kerr Consulting has a proven track record of helping non-profits successfully implement Sage Intacct, ensuring that they maximize their financial resources and streamline operations. With a deep understanding of the unique needs of non-profits, Kerr Consulting tailors Sage Intacct solutions to enhance transparency, compliance, and overall financial management.