RAMP & SAGE INTACCT

Everything you need to control spend and optimize finance operations. Apply now and get a $500 Sign-up Bonus

What is Ramp?

Control spend with global card services, service expense management, simplify procurement, and automatically sync transactions with Sage Intacct.

Ramp is the ultimate platform for modern finance teams. Ramp provides an all-in-one solution that allows you to manage business spend across corporate cards, expenses reimbursements, vendor bill payments, and procurement, ultimately building healthier businesses. With Ramp and Sage Intacct, finance and accounting teams can automate tedious tasks, ensure accuracy, and close the books faster to save more time and money.

Why Ramp and Sage Intacct?

Ramp integrates seamlessly with Sage Intacct and it is a Sage-recommended solution. Work with cutting-edge technology, receive best-in-class support, and grow with a solution that scales with you

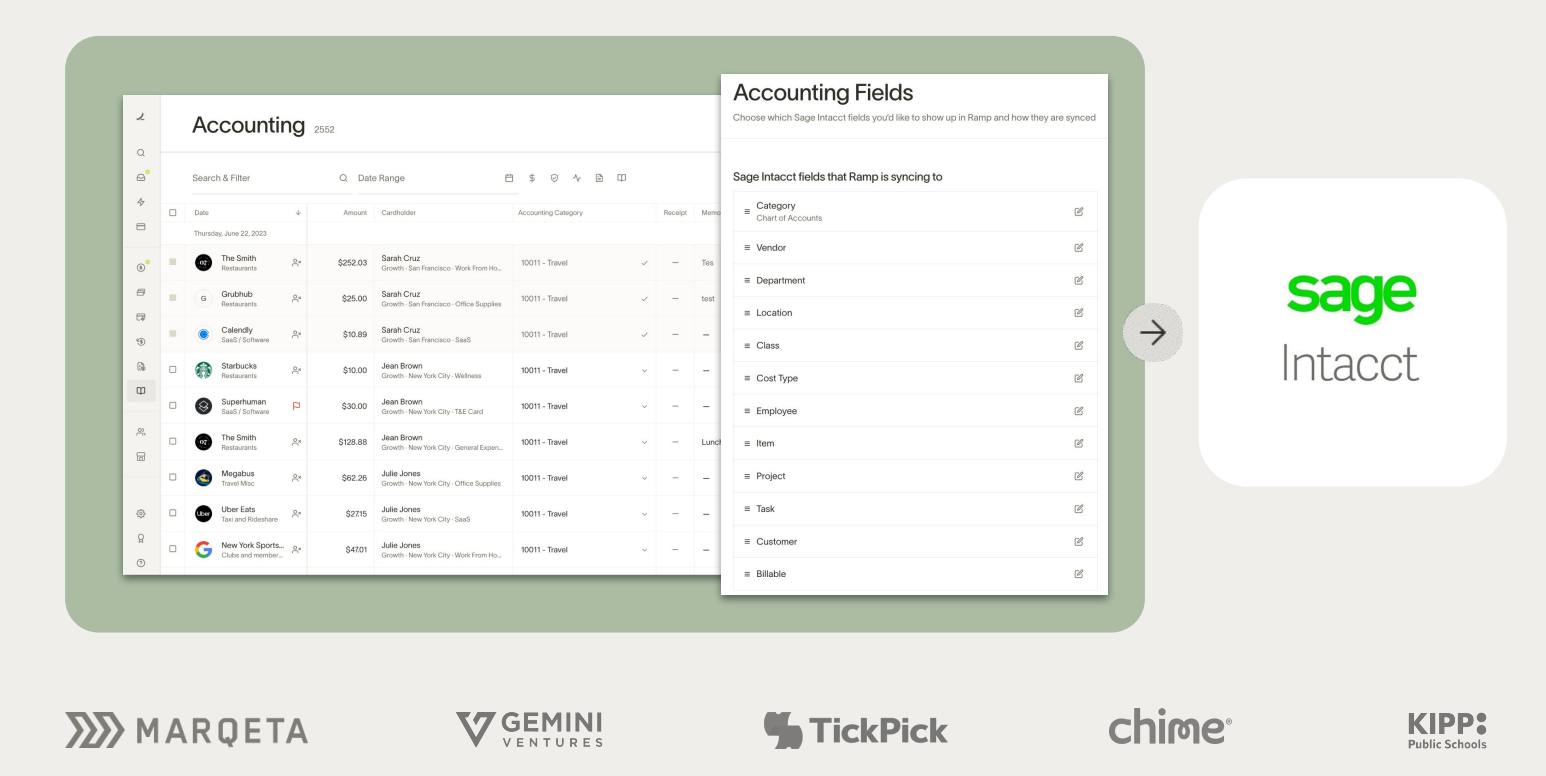

Custom Field and UDD Support

Ramp supports custom fields and UDD to maintain your reporting needs to any required fields in Sage Intacct. Control which fields employees are able to view and automate common transactions with accounting rules to streamline manual efforts.

Custom Multi-Entity and International Support

Manage all related entities within a single Ramp instance in USD or local currency. Connect relevant bank accounts, customize your approval and routing workflows, and gain increased visibility into expenditures across all entities and types of spend.

Enriched Data and Receipt Syncing

Syncing transactions at the card transaction level offers greater detail for tracking and review within Sage Intacct. Empower your financial team with the confidence of data integrity and timeliness by leveraging Ramp’s proprietary API integration.

Ramp Automates Finance Operations

Modern, Easy Expense Management

Ramp is the ultimate platform for modern finance teams. From corporate cards and expense management to bill payments and procurement, Ramp’s all-in-one solution is designed to automate finance operations and build healthier businesses. Over 25,000 businesses have switched to Ramp to save an average of 5% and close their books 8x faster

Keep Accurate Records

It can be challenging to ask employees to track every little bit of paper, scan each one, and then re-enter all the same details. Errors happen, and not every expense is easy to track. Ramp's platform can prevent employee errors by automatically collecting every receipt while ensuring that employee expenses are coded and categorized consistently.

Save Time on Repetitive Tasks

Ramp's smart, data-driven platform will offer accurate suggestions on how to categorize your expenses, based on thousands of past transactions and patterns. The more you use it, the better it gets.

Expedite Final Review

Ensure compliance without reviewing every line item. Ramp leverages automation to process countless transactions, identify mistakes, and flag issues that need attention.

Built to Scale with You

Reliably sync your data in real time with just one click using Ramp’s accounting software integrations and API. Whether you’re a multi-entity global business or a growing organization, Ramp helps you scale while maintaining data security and reliability

Integrate With Your Existing Apps

Ramp is on a mission to help customers save their most valuable resources – time and money. Our accounting integrations automate your processes so you close your books 8x faster. Streamline your finance operations by connecting to popular accounting, collaboration, and security tools, as well as multiple bank accounts within Ramp.

Ramp fully integrates with Sage Intacct

These integrations enable customers to sync their spend data between Ramp and Sage Intacct to:

● Automate categorizations

● Review thousands of transactions

● Speed up monthly close

Ramp Integrations vs. Bank Transaction Data

Traditional bank transaction data from a corporate card usually

lacks full context for the expense transaction — there’s the amount, a date, and a merchant. Cardholders are still required to provide additional context before finance teams can code a transaction, complete reconciliation and perform a monthly close. Context gathering usually happens outside a system (like via email) which can be hugely inefficient.

Ramp

incorporates accounting rules and coding into the card issuing process, so that any transactions can automatically be coded with the right GL accounts in real time, and context is gathered from cardholders as they spend on cards. These transactions create expense records which are instantaneously matched against the bank transaction data. This provides an accurate reflection of expense spend in

close to real time so you can make financial decisions with the latest data.

Apply Now and get a $500 sign on bonus: