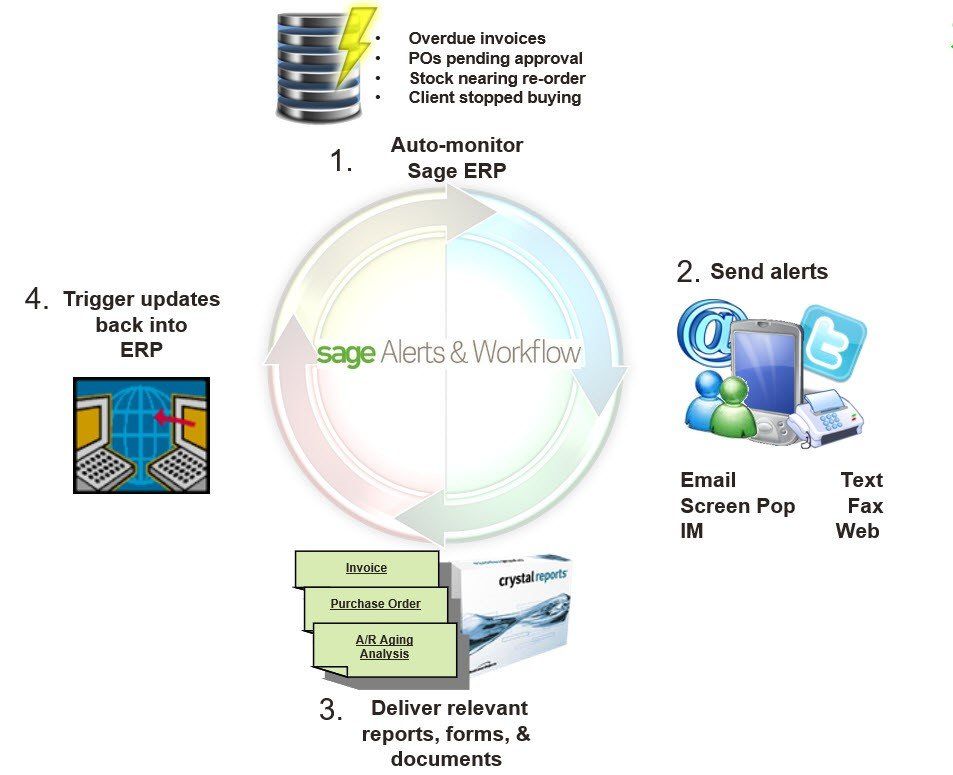

Alerts

Keep people informed. Deliver automated alerts about any business conditions, such as overdue invoices, critical support issues, or contracts about to expire. Deliver the alerts via any method, any device, including email, text message, fax, dashboard, or instant message. And send them to everyone; employees, customers, and suppliers - in the format they want, and when they need them the most.

Workflow

Streamline processes by automating best practices. When a client becomes overdue, automatically put them on credit hold; when stock runs low, auto-create a purchase order. And if a support request is received via email, turn that message into a support ticket. Move data between applications; and create custom integrations that turn resource-intensive manual processes into automated business activities.

Reports

Auto-deliver relevant forms, documents, and reports to the people who need them. Automate the generation and delivery of invoices to customers, purchase orders to suppliers, and analytical reports to managers. Schedule reports to auto-distribute based on any recurring schedule and in the requested format and configure other reports to auto-run only when the business conditions warrant it.

The "Health" of a Business

Days Sales Outstanding: DSO measures how much of a company's credit sales are tied up unproductively as accounts receivable.

The lower the DSO number, the more efficient the company. E.g., a company with an average A/R balance of $640,000 over 30 days and total credit sales of $742,000 for the same period has a DSO of 25.9 days.

DSO measures the efficiency of a company's A/R management. Revenue tied up in receivables cannot be used to fund operations or grow the business.